How to Find Your VAT Certificate: 3 Useful Methods

Can not find your VAT certificate? Don't worry! This article is here to help!

A VAT certificate is a must-have for any business registered for VAT. It's your go-to document for everything from tax returns to cross-border trade. This guide will walk you through how to find a VAT certificate efficiently, along with 3 practical methods to ensure your financial and tax affairs run smoothly.

Please note that new start-ups have no VAT registration certificate. We will also explain what it is and why it is important, plus guide you through the registration process.

What is the VAT Certificate Meaning

A VAT certificate is an official document issued by a tax authority. It is used for confirming a business or individual has been legally registered as a VAT taxpayer. With it, the holder has the right to issue VAT invoices and enjoys relevant tax incentives.

To obtain a VAT certificate, it is required to apply to the local tax authorities first. Then, offer relevant business details and financial records to prove eligibility. Once receiving the VAT registration certificate, the taxpayer is obligated to regularly file VAT returns to ensure VAT compliance.

Key information on a VAT certificate includes:

- VAT registration number

- Registration date

- Certificate date

- Business name

- Trading name

- Business type

- Trade classification (SIC code)

- Principal place of business address

- VAT Return dates

Additionally, it is crucial to keep your VAT certificate details up-to-date. If there are any changes to the business, like a new address or business name, get in touch with the tax authority right away to update your certificate.

How to Find VAT Registration Certificate

Fortunately, there are a variety of viable methods to help you easily find your VAT registration certificate. Even if you've accidentally lost it or can't find it, they can really help. Let's explore!

Method 1. View Your VAT Certificate Online with the Tax Authority Website

In fact, you can take it easy even if you lose your paper certificate. You can easily view and download a copy of the VAT certificate online by accessing the official website of the tax authority that issued the certificate. For example, for UK VAT-registered businesses, the HMRC website has you covered. Here are the detailed steps.

Step 1. Sign in to Your HMRC Business Tax Account

Access the HM Revenue and Customs (HMRC) online services. Then, log in with your Government Gateway user ID and password.

Step 2. View Your Online VAT Certificate

Once logged in, scroll down and click on "View your VAT account" under the "Making Tax Digital VAT" section. Then, you will see all the details about your VAT management on the screen.

Step 3. Get a Copy of Your VAT Certificate

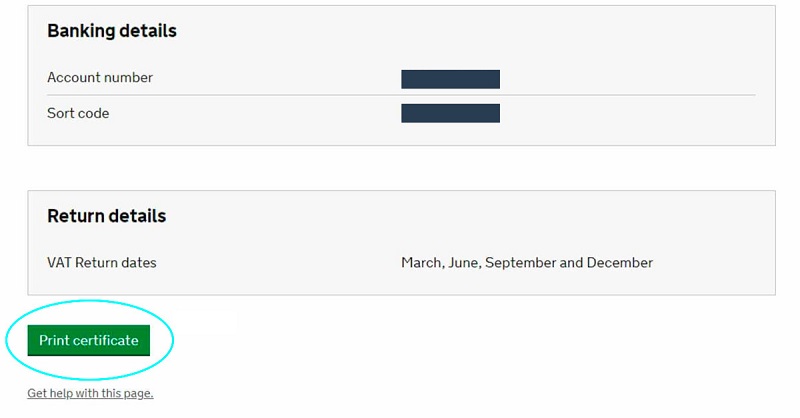

Next, click the "View VAT certificate" option to see your online VAT certificate. Here, you can simply click on the "Print certificate" button or download it as a PDF file to get things done.

Method 2. Find Your VAT Certificate Online with Email Records

When you initially registered for VAT, the tax authority sent you a confirmation email, which usually included a PDF of your VAT certificate. You can find and download this attachment by searching your emails. Simply type in relevant keywords in the email, such as "VAT certificate" or "VAT registration certificate", to quickly find the email.

However, confirmation emails sent by different tax authorities may not be in the same format, and some emails may not have an attachment, or the attachment may not be in a PDF file.

Method 3. Check Daily Business Records

Sometimes you may accidentally put the VAT certificate in the wrong folder. By going through your daily business records and files one by one, you may be able to trace its whereabouts.

Additionally, invoices, transaction contracts, and other documents often have the VAT registration number marked on them. If you cannot find the certificate, the information on these documents can serve as a substitute to offer support.

How to Get a VAT Certificate Online

Most EU countries today offer access to online applications. You can directly visit the local tax official website to start the registration process. Here are the common steps:

- Take a look at our ultimate guide to VAT registration and check if you are eligible.

- Decide to register for which country's VAT.

- Prepare the necessary documents according to the local VAT regulations.

- You can head to the local tax authority's official website, and fill out the registration form online. Then, follow the on-screen instructions to offer your company details and upload documents. Alternatively, you can hire a VAT compliance service for simplified handling.

- Confirm everything you enter and upload. Next, submit.

- Wait for like 2 to 8 weeks to obtain your VAT registration certificate.

When Will the VAT Certificate be Available

There is a waiting period, usually 30 working days after you have been approved for VAT registration. However, the actual processing time may vary depending on specific circumstances. If you have not received any updates for more than a month, it is advisable to contact the local tax authority directly for assistance.

FAQs on VAT Certificate

Q1. Business tax or VAT registration certificate? Are they the same thing?

No. While both are related to taxation, they are not the same.

A business tax certificate also refers to a business license in the US. It is one of the credentials to prove that the company can legally operate in the United States. Corporations and LLCs are common business entities that require this registration.

VAT registration certificate is specific to value-added tax (VAT) and is required in many countries except for the US. Typically, businesses that meet certain sales thresholds or deal in specific goods and services need to obtain this certificate.

Q2. GST or VAT certificate, what is the difference?

You may have heard of both VAT and GST, and they are often confused. While both are similar in some ways, there are actually significant differences. The major differences between VAT and GST are:

Definition

VAT: A tax on the added value at every step of a product's journey.

GST: A comprehensive tax is imposed on the supply of goods and services.

Tax Structure

VAT: Different tax rates across regions.

GST: Unified tax rates

Implementation

VAT: Administered by individual states or local jurisdictions.

GST: Administered at the national level for uniformity across regions.

>> Learn more: A Comprehensive Comparison: GST vs VAT

Q3. What is a VAT exemption certificate?

A VAT exemption certificate is a supporting document for international businesses. It helps prove that the goods or services they purchase are exempt from VAT. Those with this certificate do not have to pay VAT on certain specific transactions. Such certificates are common in non-profit organizations, educational institutions, medical facilities, and charities.

>> Further Reading: VAT Exempt vs Zero-Rated VAT: What Are the Differences

Overall, with this article, you can easily solve the problem of how to find a VAT registration certificate. If you are not yet registered for VAT, here can also help. Remember, a VAT certificate is more than just a piece of paper, it is a passport for your business to operate legally. Please keep it properly.

Get Help from VATAi VAT Experts

VATAi, as a professional tax solution provider, is committed to providing you with efficient and convenient VAT compliance services. It helps you obtain a VAT certificate smoothly and provides professional tax consultation for tax questions. Choose VATAi to make your tax affairs more hassle-free. With it, you can enjoy:

- Cost-effective services. VATAi offers transparent and clear price plans with fixed annual pricing and no hidden fees. You can enjoy high-quality VAT compliance solutions at an affordable price.

- User-user friendly experience. VATAi simplifies the process of VAT compliance. From VAT certificate application to VAT filing, all you need to do is offer the required documents and sales data and let VATAi do the rest.

- Timely customer support. Paid customers will have a dedicated account manager, who not only provides real-time online support but also customizes solutions tailored to your needs.

Need Help with VAT Compliance?

Book a free call with VAT Ai today to find tailored solutions for your e-commerce business